Getting paid promptly and securely in the field is crucial to keeping your business running smoothly.

Yet, many businesses like yours still deal with the hassle of manual check processing—collecting paper checks, waiting days for payments to clear, and making trips to the bank.

This process eats up valuable time. Not to mention, it increases the risk of lost or stolen checks.

Enter ACH Check Capture, the latest feature for Service Fusion’s FusionPay platform.

With ACH Check Capture, you can process check payments in the field. This gives customers flexible payment options, boosts security, and reduces administrative burden.

In this article, we’ll examine how ACH Check Capture works and the advantages it offers businesses and their teams who work in the field.

Let’s dive in!

RELATED ARTICLE: How to use ACH Check Capture (Step by Step Guide)

Understanding ACH Check Capture

ACH Check Capture is designed to simplify and modernize check payment processing. It eliminates the need to take physical checks to the bank.

Instead, you scan the check with the camera on your mobile device. FusionPay then automatically reads and captures the information on the check. The payment is then electronically processed through ACH. Once the check is processed, the funds are transferred directly between your customer’s bank and yours.

This eliminates manual entry errors and delays, minimizes paperwork, no more trips to the bank and ensures you get paid more seamlessly. It also enhances the security of your payments by removing the risk of losing the check.

Your customers will love it, too. They can still pay by check if they prefer. However, they won’t be anxiously waiting for you to deposit their check.

ACH Check Capture Benefits for FusionPay Users

“Our field workers have found the ACH check capture feature to be seamless and user-friendly, allowing them to easily manager transactions without needling to return to the office. This not only saves time but also boosts productivity, enabling our team to focus on their core responsibilities in the field.” – Shannon Hunter (Service Department Coordinator, Daniell Heat & Air)

The ACH Check Capture feature offers a variety of benefits to current FusionPay users. Let’s explore how you can leverage this feature to improve your payments.

Improved Efficiency

ACH Check Capture simplifies the check processing workflow. By scanning checks into FusionPay, you’ll see:

- Reduced Manual Errors: Manually entering payment information or handling physical checks often leads to mistakes. ACH Check Capture improves accuracy and reduces the risk of human error.

RELATED ARTICLE: How Field Service Companies Can Improve Cashflow with Digital Payments

Cost-Effective

ACH transactions are one of the most cost-effective payment solutions. They combine the convenience of digital payments without cutting into your revenue. Here’s how:

- Lower Processing Fees: ACH payments usually have lower fees than credit card transactions. ACH Check Capture has a 1% + $0.30 fee per transaction. Lower fees mean higher cost savings over time.

Better Customer Experience

In today’s competitive market, customer satisfaction is critical. ACH Check Capture is another way you can deliver exceptional service. Here’s how:

- Greater Payment Flexibility: ACH Check Capture helps you cater to customers who are wary of credit card payments. They get to pay exactly how they prefer. However, you still get the benefits of modern digital payments.

- Prevent Lost Checks & Reduce Hassle: With ACH Check Capture, there’s no risk of losing physical checks, eliminating the need to ask customers for a replacement. This ensures a smoother payment experience, reducing frustration and maintaining trust.

Peace of Mind and Reliability

ACH Check Capture can bring greater peace of mind to business owners. Here’s how:

- Handle Payments Better: ACH Check Capture helps you manage payments more effectively. It reduces the risks associated with manual payments. Not to mention, it gets you paid faster, so your revenue stream is steady.

Seamless Integration

Jumping between software wastes time and leads to inefficient processes. ACH Check Capture streamlines your payment process. Here’s how:

- FusionPay Integration: FusionPay is fully integrated into Service Fusion. That means your payments are synced with your other workflows. You can invoice, manage payments, and generate financial reporting from a single platform.

FROM ONE OF OUR PARTNERS: How Do ACH Payments Work?

How to Use ACH Check Capture

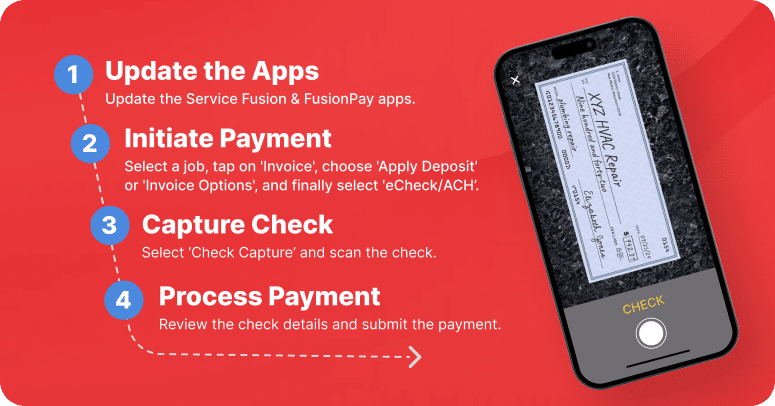

Another benefit of ACH Check Capture? It’s simple to use. Here is a step-by-step guide to using this payment feature.

- Open the Service Fusion and FusionPay Apps: Ensure that the latest version of the app is installed on your mobile device.

- Access the ACH Check Capture Feature: Navigate to the payment processing section and select “ACH Check Capture.”

- Scan the Check: Use your device’s camera to capture a clear image of the customer’s check.

- Verify the Details: Review the captured check details for accuracy and confirm the payment.

- Submit the Check for Processing: Once everything looks good, submit the payment for processing. The funds will be transferred electronically, and you’ll receive confirmation.

Adding ACH Check Capture to Your Payments Process

Ready to utilize this feature for your field service business? We have you covered!

Are you a Service Fusion user? Check out our knowledge base article on using ACH Check Capture.

If you encounter any issues or have questions about setting up or using the ACH Check Capture feature, our support team is here to help. You can reach out to us via:

- Email: [email protected]

- Phone: 1-888-902-0304

Not a Service Fusion customer? We’d love to help you transform your payment process. Schedule your demo to see ACH Check Capture in action.

Related Posts

The Essential Painting Equipment List for Your Business

Continue ReadingGet Inspired: Our Favorite Actual Pool Company Names

Continue ReadingStay Informed

Get the latest news and insights plus, Service Fusion offers and updates.Thank you for your submission.

SHARE